XRP Price Prediction: Technical Breakout and Institutional Adoption Point to Bullish Outlook

#XRP

- Technical Breakout Potential: XRP is testing key resistance levels with MACD showing bullish momentum signals

- Institutional Adoption: Partnerships with BlackRock, VanEck, and regulatory engagement provide fundamental support

- Range-Bound Trading: Current $2.80-$3.30 consolidation phase requires breakout confirmation for sustained moves

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

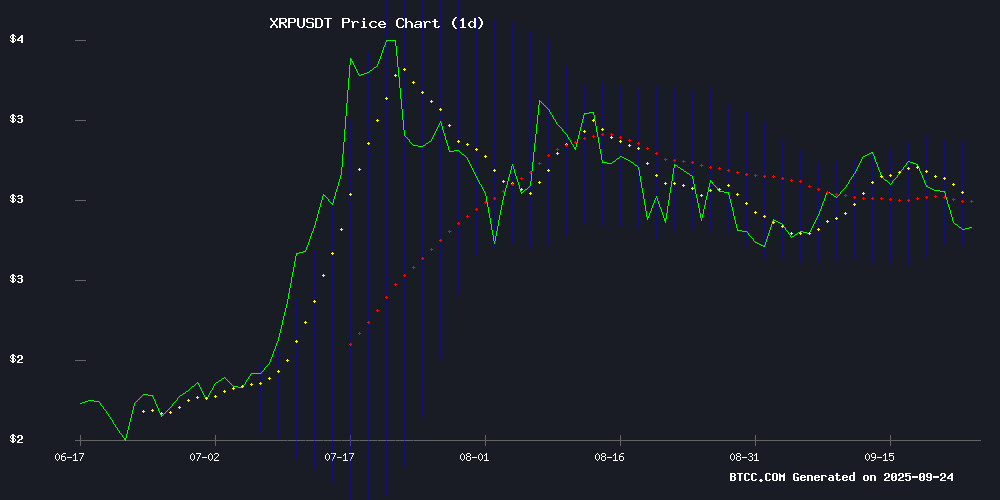

XRP is currently trading at $2.88, slightly below its 20-day moving average of $2.97, suggesting potential resistance ahead. The MACD indicator shows a bullish crossover with the histogram at 0.0223, indicating improving momentum. Bollinger Bands reveal the price is trading NEAR the middle band, with immediate support at $2.78 and resistance at $3.16. According to BTCC financial analyst Emma, 'The technical setup suggests consolidation within the $2.80-$3.30 range, with a break above $2.85 potentially triggering further upside.'

Positive Catalysts Drive XRP Sentiment

Recent developments including Ripple's participation in US-UK crypto policy dialogues and RLUSD stablecoin integration with BlackRock and VanEck are creating positive market sentiment. Institutional adoption through BlackRock's $2B BUIDL Fund exploring XRP Ledger expansion adds fundamental strength. BTCC financial analyst Emma notes, 'The combination of regulatory progress and institutional partnerships provides strong tailwinds for XRP's medium-term prospects, though technical levels must be respected.'

Factors Influencing XRP's Price

Ripple Engages in US-UK Crypto Policy Dialogue

Ripple, a leading blockchain firm, participated in a high-level roundtable in London to discuss digital asset policy alignment between the United States and the United Kingdom. The meeting, held on September 20, included key figures such as U.K. Chancellor Rachel Reeves and U.S. Treasury Secretary Scott Bessent.

The discussions centered on transatlantic cooperation to establish global standards for blockchain innovation. Ripple's presence underscores its influence in shaping regulatory frameworks for the crypto industry.

Cassie Craddock, Ripple's managing director for the U.K., highlighted the potential for a US-UK partnership to serve as a model for international collaboration in the digital assets space.

Ripple Joins Forces with US and UK in Digital Asset Leadership Push

Ripple took center stage at a high-level meeting between U.S. and UK officials on September 24, advocating for synchronized cryptocurrency regulations. The Downing Street discussions focused on creating a unified framework to foster innovation while maintaining market stability—a move that could set global standards for digital assets.

The blockchain company emphasized the critical need for regulatory clarity, arguing that coherent policies would accelerate sector growth and attract investment. This bilateral dialogue marks a significant step in aligning two of the world's largest economies on blockchain technology governance.

As global crypto regulations evolve rapidly, Ripple's prominent role in these negotiations underscores its strategic positioning within the industry. The outcomes could shape cross-border cooperation and institutional adoption of digital assets in the coming years.

XRP Price Prediction for September 2025—Here’s What Could Trigger a Rebound to $3.60

XRP's price action in September 2025 is poised at a critical juncture as the token consolidates near key support levels. Market participants are closely monitoring liquidity shifts and buying pressure, with momentum building around its long-term structure. A decisive rebound from current ranges could ignite stronger demand, potentially propelling XRP toward the $3.60 zone.

Institutional activity and regulatory clarity are shaping XRP's trajectory. The launch of the first U.S.-listed XRP ETF drew $37.7 million in initial volume, signaling robust demand despite early profit-taking resistance. Ripple's partnership with DBS and Franklin Templeton to tokenize money market funds on the XRP Ledger adds structural support, particularly as adoption accelerates. Active XRPL accounts surpassing 7 million further underscore growing network utility.

Ripple's RLUSD Stablecoin Integrates with BlackRock and VanEck Tokenized Funds

Ripple's RLUSD stablecoin is now accessible through tokenized money-market funds managed by BlackRock and VanEck, offering investors a seamless redemption path into on-chain liquidity. The integration, facilitated by Securitize's smart contract platform, enables holders of BlackRock's BUIDL and VanEck's VBILL funds to swap shares for RLUSD at any time. This creates a 24/7 stablecoin off-ramp for tokenized treasuries, positioning RLUSD as a settlement layer for real-world assets (RWA).

Jack McDonald, Ripple's SVP of Stablecoins, emphasized the partnership as a bridge between traditional finance and crypto, highlighting RLUSD's regulatory compliance and enterprise-grade design. Backed 1:1 by liquid reserves and issued under a New York DFS trust charter, RLUSD has surpassed $700 million in circulation since its launch last year. Ripple is pushing its adoption in cross-border payments, DeFi pools, and now institutional RWA platforms.

The collaboration with Securitize also paves the way for RLUSD's deployment on the XRP Ledger, combining regulatory-compliant stablecoin issuance with DeFi utility. This dual approach strengthens Ripple's foothold in both institutional and decentralized finance ecosystems.

RLUSD Stablecoin Gains Traction as Institutional Bridge Between TradFi and Crypto

Ripple's RLUSD stablecoin has surged to a $741 million market cap following its integration with Securitize's platform, creating a crucial off-ramp for BlackRock's BUIDL and VanEck's VBILL tokenized funds. The 24/7 conversion mechanism marks a significant leap in institutional crypto adoption, offering instant liquidity without traditional settlement delays.

The stablecoin maintains near-perfect parity at $0.99988, demonstrating remarkable stability since its December 2024 launch. Its enterprise-focused design has gained regulatory recognition for asset tokenization purposes, positioning RLUSD as a preferred settlement layer between traditional finance and blockchain networks.

XRP Breakout Alert: Key $2.85 Zone Could Trigger $9.6–$33 Rally

XRP is trading at $2.8509, holding above the critical support zone of $2.75–$2.79. A weekly close above $2.95 could pave the way for a retest of $3.25 and potentially $3.66, with long-term targets ranging between $9.6 and $33 based on historical cycles.

The token's bullish structure remains intact, supported by rising higher time-frame EMAs. Momentum indicators like the weekly RSI and MACD suggest neutral-to-bullish conditions, with resistance near $2.92–$2.95 acting as the next hurdle for buyers.

XRP Ledger Validator Migration Nears as mXRP Token Arrives

The XRP Ledger is undergoing a critical transition as operators migrate from the legacy XRPL Foundation to the newly established XRPL Foundation. The shift centers on the default Unique Node List (dUNL), which governs trusted validators maintaining network consensus. Nodes failing to update risk disconnection starting September 30, 2025, with full deprecation by January 18, 2026.

Community validator VET has underscored the urgency, warning of operational disruptions for lagging services. This technical overhaul carries broader implications for XRPL's stability as it expands into DeFi and other sectors—decoupled from the mXRP token launch but aligned with the ledger's evolution toward decentralized resilience.

Can XRP’s September Performance Top August’s Wins?

XRP trades at $2.87, showing bearish momentum with MACD and RSI indicators lagging behind August's performance. Despite this, historical trends suggest a potential rebound, with September posting gains of +3.35% in 2025, consistently outperforming August.

Whale activity and growth projections hint at bullish potential, raising the possibility of September surpassing August's gains. Ripple Labs' XRP distinguishes itself by facilitating cross-border payments for financial institutions, offering a faster, cheaper alternative to traditional systems like SWIFT.

August saw XRP break past $3 with strong bullish momentum, but September's price hovers near $2.87, with RSI at 42 and MACD flattening—signs of weakening momentum compared to last month's rally.

XRP Targets $3.14 Amid Whale Accumulation and DeFi Yield Launch

XRP's price trajectory is gaining momentum, fueled by strategic whale purchases and the introduction of mXRP, a novel DeFi yield product. The cryptocurrency currently trades above $2.85, with technical indicators suggesting potential upside to $3.14—and possibly $3.42 upon a decisive breakout.

The mXRP staking platform, developed through collaboration between Midas, Interop Labs, and Axelar, offers XRP holders up to 8% annual yield. This innovation taps into previously dormant XRP supply, creating productive utility for the asset. "This marks a watershed moment for XRP," notes Axelar co-founder Georgios Vlachos, highlighting the product's ability to bridge XRPL with decentralized finance ecosystems.

Initial availability is limited to Europe and Asia, though expansion plans loom. Market participants now watch whether institutional interest and yield-seeking demand can propel XRP past critical resistance levels.

BlackRock's $2B BUIDL Fund Eyes XRP Ledger Expansion via Securitize Partnership

Securitize's planned integration with XRP Ledger could pave the way for BlackRock's $2 billion BUIDL fund to enter the XRPL ecosystem. The tokenization platform's move signals accelerating institutional adoption of blockchain infrastructure, particularly in the real-world asset sector where XRPL has recently gained traction among major financial players.

XRP Ledger's RWA capabilities have attracted Guggenheim, VERT, and Dubai Land Registry, propelling it into the top ten blockchains for tokenized assets. Ripple's strategic roadmap further positions XRPL as a hub for stablecoin transactions and institutional DeFi applications, with native assets XRP and RLUSD serving as key components.

The potential arrival of BlackRock's industry-leading money market fund would mark a watershed moment for XRPL's credibility. Simultaneously, Ripple and Securitize are deploying smart contracts to enable 24/7 trading of tokenized fund shares—including BUIDL and VanEck's VBILL—against RLUSD liquidity.

XRP Price Fluctuations: Will It Break Out of the $2.80 to $3.30 Range?

XRP started the week trading between $2.80 and $2.90, facing strong resistance at $3.05-$3.10. The cryptocurrency hovered near $2.86-$2.88, testing the patience of bullish traders waiting for a breakout.

A midweek rally, fueled by a rate cut, briefly energized the market before momentum faded. Prices settled into a familiar pattern, forming wicks around $3.07-$3.13. This consolidation leaves investors questioning whether XRP is gathering strength for a major move or simply marking time.

The broader economic backdrop plays a crucial role. Central banks' dovish policies, aimed at stimulating growth amid inflation and geopolitical tensions, are pushing investors toward riskier assets. Cryptocurrencies like XRP typically benefit from such environments as capital rotates out of low-yield instruments.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment case with measured risk. The cryptocurrency is trading at $2.88 with several positive catalysts underway.

| Metric | Current Value | Significance |

|---|---|---|

| Current Price | $2.88 | Below 20-day MA, potential buying opportunity |

| 20-day Moving Average | $2.97 | Immediate resistance level |

| Bollinger Band Support | $2.78 | Key downside protection |

| MACD Signal | Bullish Crossover | Positive momentum indicator |

BTCC financial analyst Emma suggests, 'XRP's institutional partnerships and technical positioning around critical support levels make it attractive for investors with a 3-6 month horizon. The $2.85 breakout level remains crucial for confirming upward momentum.'